Having a good handle of your company’s cash flow is crucial to be able to manage the current business operations and execute intended business projects.

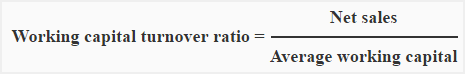

The information provided by the working capital turnover ratio is important in the overall process of working capital management operations. What does the capital turnover ratio provide as information? Many companies also have a line of credit that they can use to manage ups and downs in their cash needs if they do not have enough cash in their bank accounts or money coming in from the collection from their account receivables. Then, a company can generate more working capital by selling goods and merchandise it has in its inventory to customers (leading to the company invoicing for the goods sold and then collecting). If the company does not have the money sitting in the bank account, the next source of funding is from customers paying their invoices and how well a company is able to collect on outstanding accounts.

Money in the bank account will serve as an immediate source of funds to pay for any short-term financial obligations or business operational expenses. The availability of lines of credit of other sources of funding.How well it is able to sell goods kept in inventory.How well it collects its account receivables.How much money a company has in its bank accounts.There are several factors that will have a direct impact on a company’s working capital:

0 kommentar(er)

0 kommentar(er)